Taxing Les' Patience (and Property)

Today's guest blogger is Les Kniskern. Les is a constituent of mine from the Greater Rockwell neighborhood, not far from the Governor's residence. Les has been actively involved in community issues for some time now. Most recently, he has been engaged in efforts to mitigate the negative business impact from the station closures that have accompanied the CTA Brown Line Expansion Project.

Today's guest blogger is Les Kniskern. Les is a constituent of mine from the Greater Rockwell neighborhood, not far from the Governor's residence. Les has been actively involved in community issues for some time now. Most recently, he has been engaged in efforts to mitigate the negative business impact from the station closures that have accompanied the CTA Brown Line Expansion Project.His other passion has been the issue of skyrocketing property taxes and the underlying issue of how we assess properties in Cook County. Les is not a 'special interest', nor is he an 'insider'. His story and experience is that of many of my constituents, and he was interested in sharing them with readers here.

While there are various points that I would love to expound upon, and may at a later date, for today, I will try to stay on the sidelines for this post, and let those of you that choose to do so, debate the issue amongst yourselves or with Les.

For a related story, you can read Ben Joravsky's article in this week's Chicago Reader.

Without further delay, I give you Les Kniskern:

I’m tempted to post the phrase “7% solution” and let the comments fly, but since Rep. John Fritchey has graciously invited me to post as a guest blogger, let me share thoughts from a homeowner’s perspective.

My wife and I formed a partnership with another couple to purchase a

As first-time homeowners we never anticipated a 59% assessment increase in 2003, only one year after our purchase. This was not a rehab, we’re still hoping for the day when we can afford new windows – but the broken sewer line took precedence this year.

Our dear neighbors, elderly sisters who still resonate with the accents of their home country, worry with me over the fence as we discuss how to care for different plants in our garden. “What,” Otillia asks, “are we to do? How can we pay our taxes and keep our home?” Their home of 17 years, and 63% assessment increases.

Other neighbors, who’ve battled gang influence, cleaned up graffiti, and planted corner gardens to make this a neighborhood to be proud of, are no longer fearful of losing their possessions to crime, but of losing their homes to taxes.

There seems to be a perception that increased property values are a boon to the homeowner. Appreciation means more money in your pocket, right? Take the money and run. Yet, this boon is only offered to the investor who flips a commodity, or the seller who moves from location to location.

At the crux of the assessment debate is the homeowner whose interest lies not in profit, but in the home. Individuals seeking a residence with stability, a community in which to live, neighbors on which to rely. In order to build such a place, a commitment must be made to its residents. To make a stable community, and ultimately a better State of

Escalating assessments and out-of-control property tax increases threaten this type of homeowner.

The property tax debate must not be looked at as an “us” vs. “them” proposition, but rather as a delicate eco-system comprised of property owners, commercial interests, and political gain.

For a run-of-the-mill homeowner, understanding these complexities can be hard. Even more difficult is that the State of

The “7% solution” is a misnomer, whereas it should have been called the “7% bridge,” to a more permanent solution.

13 Comments:

Many suburbanites share the pain of Chicago homeowners who see huge increases in their property taxes.

And, given the slowing of housing prices, those increases in value

which seemed to offset the property tax increases may be ending, or at least slowing dramatically.

Many believe that the solution is an increase in the income tax coupled with property tax reduction. What most people don't realize, however, is that the state cannot mandate the county and local governments not to tax.

If past trends are any indicator, local and county taxing bodies would, in the event of a tax swap, simply vote to raise property taxes to their previous levels.

So taxpayers would be left with a permanent increase in the state income taxes and the same or higher property taxes as before, within a couple of years of the tax swap's implementation. In addition, for many communities, the tax swap would result in monies leaving the community (via the income tax) to fund schools in areas which claim "poverty" and so on. They would be forced to raise property taxes to make up for the loss of school funds resulting from the tax swap.

As property taxes continue to rise, let's remember that a tax swap as proposed by many liberal advocates will not result in lower property taxes. They will result in an increase in the total tax burden.

John & Les -- the reality is that today's modern finance techniques should enable homeowners to capture the value of their property without "flipping" it. An older couple I know in an inner suburb worked with a trusted financial advisor to use life insurance and a reverse mortgage to cover all of their property taxes and then some. They were amazed at how easy it was to generate a stream of income to help pay for the upkeep of their home. Of course, with the rash of mortgage fraud cases lately, homeowners are and should be wary of anyone promising an easy fix.

John, the solution is some combination of more aggressive regulation AND support from government for better education about some of the tried and true alternatives to the situations Les describes.

Property taxes as a percentage of property value are about as low in Chicago as one can find anywhere in Illinois.

Chicago homeowners pay about 1% of what their property is worth in real estate taxes each year.

2% is closer to the norm elsewhere in Illinois.

Cal,

You are not supposed to tell anyone that!

I wish this had Spell Check!

Les, that was a very thoughtful post. Your description of the 7% as a bridge to reform opens up an avenue for discussion of what real reform would look like.

As we are all waiting with sweaty palms for our reassessment notices to hit here in the city we are reminded that our assessments are going up because of the formula set forth in the state and not because of the way we fund schools.

This is an important distinction because there is still a lot of talk about the tax swap and how changing to a higher income tax (try 67% increase) will somehow relieve the property owner of high taxes and make schools better at the same time. Nothing could be farther from the truth.

Again, our property assessments don't skyrocket every three years because of an increase in funding schools. Our assessments go up because some of our neighbors sold their properties and that "appreciation" is applied to all our homes. We all are paying higher taxes because the value of our homes is determind by someone else selling. This the flaw in the system that needs to be changed.

We need to change this assessing system that has not been addressed in over 50 years! It isn't about increasing our income tax by 67% or applying a sales tax on services...we need to change the way we assess properites pure and SIMPLE.

Property taxes should be FAIR and PREDICTALBE FOR ALL - homes, condos, commerical and industrial!

Assessments of all properties should be held to a fixed minimum of 2% a year UNTIL A PROPERTY IS ACTUALLY SOLD. The new owner would be assessed on the actual sale price. A new owner would know up front what their taxes would be - a novel concept. These new owners would then have their assessments limited to a 2% increase until they sell.

This would prevent assessments from skyrocketing on all the other properties that are not for sale! Our neighborhoods would benefit because people,like you, that have made a commitment to their communities would not be forced to leave.

We need the 7% renewed as the bridge to ACQUISITION BASED ASSESSING. This is what real reform looks like...not raising our incomes taxes in the name of reform.

The side benefit of changing the assessment system is that the SPENDING side of this equation becomes transparent. Government taxing bodies won't be able to hide behind these "windfalls" as the tax rate drops. The citizens can concentrate on holding the elected officials accountable and question them on the spending. Again a novel concept. Fair, predictable and transparent! No wonder changing the system is so hard!

Barb Head

Tax Reform Action Coalition (TRAC)

(I hope I didn't misspell anything!)

Thank you Rep. Fritchey for this unique forum!

Actually, outside of Cook County it's usually more than 2% of the value of the property.

Outside of Cook, if your tax rate (the rate per $100 of taxable value) is:

$6.00 per $100, then you are paying 2% of the value of your property in taxes ($6.00 x .333% = .020%)

$7.00 per $100, then you are paying 2.33% of the value of your property in taxes ($7.00 x .333% = .0233%)

$8.00 per $100, then you are paying 2.67% of the value of your property in taxes ($8.00 x .333% = .0267%)

The rule of thumb always used to be that if you went over the 2.33% to 2.50% threshhold, there was big trouble (taxpayer revolt type issues) on the horizon.

We're seeing quite a number of suburban areas (outside of Cook County) where tax rates per hundred dollars of taxable value are in excess of $8.00 per hundred.

The problem isn't assessments, those really are strictly a math formula applied to the value of your property.

The problems are severalfold:

1) Massive increases in the number of Tax Increment Financing districts, with all revenues from those areas being 'frozen' for the tax districts except for the municipality, which get all the increased money through the "TIF Increment" side of the program.

2) Budgets of local tax districts. Operations like Cook County government don't even qualify as being "bloated" and "excessive" (they would have to slim down just to reach those levels).

If the taxable value (a/k/a as "EAV value" to the insiders) for Cook County goes up by 15%, and the overall Cook County tax rate goes down by say, 9%, well, that's still a 6% increase in the tax dollars comming in for just Cook County.

You want a serious debate: talk to me about the TOTAL DOLLARS from property taxes by Tax District Fund for each of the last four years for just Cook County.

It's public information, should be available in the County Clerk's tax extension office, good luck on getting it.

Now for the City of Chicago, it's a little harder. Now you've got to get the details on all the different city TIF districts and what the TIF Increment has increased for each of the last 4 years.

Dirty Little Secret: Those vaunted Tax Caps don't apply to either TIF districts or Special Service Areas.

Oh yeah, lots of games going on there.

Hopefully my only comment today is this: one of my biggest concerns with Cook County assessments isn't even economic. It's the fact that ballooning assessments are used to mask (and fund) County spending. Hold the line on assessment increases (eg. acquisition based assessments), and you force the taxing bodies to have to seek to raise the tax rate if they want more money. It's a transparency in government issue.

As such, skyrocketing property taxes are not only forcing my neighbors out of their homes, or keeping people from coming into the area to start with, they also have been key in maintaining a bloated County government. That's a brief as I can put that thought. I'm back to work.

John, and all

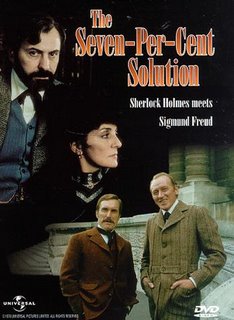

First, an anecdote. The term '7 percent solution' echoes Sherlock Holmes. There it referred to the cocaine solution he injected into his veins more than occasionally.

The Assessor's actions were of the same ilk. Like all politicians he concealed the true effect of what was being done.

The State of illinois permits only Cook County to use a classification system -- different properties assessed at different ratios to estimated market value (EMV). All the rest are supposed to assess all properties at one third of EMV.

In order to assure that this is done, and in order to distribute state funds equitably on that basis, the State equalizes the valuations County wide by assigning a multiplier for all properties in each County. In some Counties, the Assessor makes an effort to value properties at one third of EMV. If successful, the multiplier is 1.0. Otherwise the multiplier is higher, and in Cook County last year the multiplier was 2.5757.

That meant that Cook County properties were -- on average -- under assessed by 257%, if the sales ratio studies on which the multiplier is based were correct.

This not only hits residences, it whacks commercial and indutrial property. If you have a factory, the result is that you are paying $4.00 per square foot in taxes. Move the factory to Indiana, or to will County, or Lake County, or Wisconsin and the property taxes drop to around $1.25. Interesting disincentive (and one of the valid reasons why TIF is used in Chicago.) Factories and office buildings and shopping centers provide the jobs which enable people to buy houses and condominiums.

The sales as recorded of residential property and other property provide the bsis for the multiplier assigned to all property. Your neighbor's good fortune burdens you.

John Fritchey grasps one point soundly. Property taxes are a tax on wealth, not income. If income is not sufficient to pay higher taxes, some wealth must be liquidated. Liquidating wealth destroys your assets.

One step is to freeze valuations until a property is sold. Recognizing that the current owner is receiving benefits from the freeze, what can be done is to create every year a 'shadow valuation'. At the time of sale, part of the price would include the tax rate times the shadow valuation (subtracting taxes already paid on the 'recorded valuation' for, say, the three prior years. Seller's wealth will have been turned into income. This was done elsewhere in the State.

On the buyer's side the valuation based on the sales price would be recorded and frozen with taxes extended based on that new price. Of course, the real estate brokers would have to provide a good faith estimate to the buyer regarding what the new taxes would be. He might not be able to make as high an offer, but honesty would be served.

BTW, how many of you when you purchased your house got an estimate from your broker as to the NEW taxes? Not many, I see.

At the same time the State Equalizer needs to be junked for property tax purposes. Let Springfield use it for the distribution of State revenues, but it is not necessary under the above system.

The politicians have been running on the taxpayers a flim flam game with many curtains (the assesment ratios, the equalizer, the 7% solution, tax caps.) In sum they are meant to distract the taxpayer. Today, in Cook County he can not determine what his taxable valuation will be until after the first tax collection. Taxing bodies routinely pass budgets without knowing if the full amount can be extended.

Politicians want you to fall asleep, vote for the machine that is reaching in your pocketbook, or better still, don't vote at all.

The curtains need to be ripped aside.

Every property owner needs to know what is taxable valuation is and what his share of the burden will be.

The County and the individual taxing bodies provide essential services in the public sector. It is up to the taxpayer, though, to require efficiency and effectiveness in their delivery.

Every scandal that has erupted, every wastage shown cost the taxpayer money. To date, however, the attitude has been 'it's o.k. if someone else pays for it' as he turns out the lights.

He gets his tree cut, but he doesn't care that it takes a four man crew.

He pays while he is sleeping. It is time to wake up.

I love posts that draw interesting comments, thanks everybody.

The comments on this post have been extremely insightful, and I appreciate the opportunity to stir the debate.

“The problem isn't assessments, those really are strictly a math formula applied to the value of your property,” raises the issue of why the 7% in the first place. This math formula offers no protection to the homeowner in the event of, as we have experienced, an explosion of property assessment increases – 59%, 63%, and reportedly as high as 120%. Remember that the formula regulates the taxable portion to increase in 7 per-cent increments per year, not “7 per-cent per each three-year period” as erroneously reported in the Joravsky article. So, this provides for a regulated annual growth in the taxable portion of the property. It won’t take but a handful of years to reach the EAV on the property, given that the housing market is destined to slow down.

I wonder if the GA rushed to evaluate the effects of the 7% with its U of I study and looked only at the first year effects of this legislation, without carrying forward to see how this growth would start to balance out the "commercial shift" in the second, third, and subsequent years?

My brother in Washington State had this to say, “What a complicated and hard to define situation in regard to homeowner taxes. I read the nine responses to your comments and they seemed to perceive the problem (or lack of a problem) in very different ways. The "hue and cry" is missing making a possible tax payer's revolt not likely. The politicians there, like here, have masked the revenue stream in such a way that citizens do not have an open account or idea of how the money is collected or where it being spent.”

Transparency seems to be the key.

Les -

A bit of history. The current constitution makes Illinois a tax rate limit state. Except for home rule communities (Cities with 25,000 residents automatically, any others who pass a referendum, Cook County) which have unlimited taxing authority, there are statutory maximum tax rates for every fund (except pensions and debt service) of every taxing body. These can be individually increased only by referendum.

From the 1970s, property values rose faster than incomes, putting stress on the ability to pay. Taxing bodies under the maximum tax rates had the ability to raise much more money because of the higher valuations. The effect was somewhat mitigated in may locations by the construction projects which extended the taxable base.

Voters squealed, but did not in most instances vote the rascals out.

In response to this the State enacted tax caps in the form of levy limits. A taxing body other than home rule units could only raise its take based on the rate of inflation. There were adjustments for annexations, etc.

The cost of public services, however, does not rise in tandem with the rate of inflation. There are many other effects.

Take School Districts...please. Schools in a new contract may raise wages. say, 3% per year -- equal to the rate of inflation

The public is pleased. The budget then comes out and labor costs have increassed 6% or more. Nobody notices that. The problem is that in addition to the new cpntract, longevity increases, increases for additional education credit, increases for extracurricular jobs, and until most recently, huge increases during the final years before retirement which maximize pensions.

How do they get the money? Don't ask. It is complicated. I would devote another comment to that.

State law treats taxing bodies as if one size fits all -- a Procrustean bed, if you are up on your mythology.

Meanwhile, the assessments...ah, yes, the assessments keep rising. Other things being equal, if the same amount of money were being requested, the tax rates should go down and the dollars, adjusted for inflation would be the same.

Nope. Does not happen.

Since the 1970s the Cook County Assessor and the Appeals process have become more professional. My first owner occupied three flat was reassessed indicating a higher purchase price than I paid. I got ruened down at the first Appeal. The Board of Review was an eye opener. Boy. was I naive. A gentleman older than God took me and my papers into a room. He opened the top drawer on his desk next to me, looked at me, looked at the drawer, looked at my papers, and repeated the sequence four or five times. I did nothing. As I left, I realized that drawer was his collection plate.

Things have indeed changed. But...

Here is the question, Les. The official assessment ratio for your property is 16% Is it worth 6 times the assigned valuation?

The true ratios being assigned are somewhere around 10% to 11%, at least until four years ago. Then the egg hit the fan

The authority in law that was given to Cook County was that the difference in ratio between the lowest and highest clasification could be no more than 250%. Residences: 16%; Commercial 38% -- that fits. Residences 10%; Commercial can be no more than 25%

A new law was passed which established a Property Tax Appeals Board -- outside the tender grasp of the Cook County machine. They had the authority to reduce the valuations to the legal ratio and order refunds, not only for the year directly under appeal, but also provable prior years.

The de afacto residential ratio came back to bite the taxing bodies, because they had to refund money they had already spent in advance of the final appeal. It had to be paid back out of the current year's collections, which were under the new levy limits.

I am not privy to the Assessor's logic process, but I believe he did a brave thing. At the time of the last reassessment (not the recent set of triennials) he raised the de facto residential ratios from 10% to around 14%, which placed the classification system back in synch, and then added the triennial inflation factor.

This would forestall the spate of successful commercial appeals which were beggaring the taxing bodies.

What the taxpayer saw, however, was a 50& increase in AV. That scared them, even without reference to the tax bills.

Les, that is what you are seeing, if you owned the property before the 7% solution was put in. If you bought later, the 7% solution does not apply to you until your property gets reassessed.

If anyone is interested, I will discuss the 7$ solution and its vagaries in another post, John Fritchey must be getting tired of me

Wistful,

Consider this to be an open invitation to write a guest column. If you're interested, just e-mail it to me.

There are some great comments on this post. If you want some hard numbers as food for thought, you can look at the review we did recently of the Lake & Lake View townships (who were reassessed this year). The average increase in assessed value was over 90% for some property classes. The reports are at:

http://www.illinoispropertytaxrelief.com/TownshipReport.aspx?TownshipID=14

http://www.illinoispropertytaxrelief.com/TownshipReport.aspx?TownshipID=13

Post a Comment

<< Home