For a while now,

Mike Lawrence, of SIU's Paul Simon Public Poicy Institute, has probably been my favorite Illinois political commentator. He manages to deftly combine keen political insight with practical real world application and analysis.

Today's column in the State Journal-Register is no exception.

In it, Mike addresses the state of our economy and education system, and their ramifications for our long-term prognosis. For those of you too lazy to follow the link to the article, here is the second half of it:

Given our changing demographics, we should address squarely the related academic and employment achievement gaps between whites and minorities. We should enlist and empower religious and other community stalwarts to aid in the family intervention that will help disadvantaged children gain the education so vital to them and to our state.

We simply cannot field a skilled work force that will entice high-paying enterprises to locate and expand here without sufficiently funding public schools and providing an affordable array of specialized training, community college and higher education programs.

Money is not the only answer. But Illinois has a deficit in the billions and a revenue structure that can no longer fund vital needs.

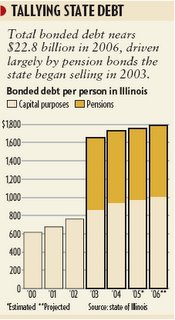

We already have burdened tomorrow’s taxpayers with too much debt. As our economy continues to change, how can we justify imposing a sales tax on goods but not services when it could generate $1 billion even if health care were exempted? How can we blithely remain one of the few states in the nation not to tax the retirement annuities of its most affluent citizens when even limiting the levy to those making $75,000 or more would reap hundreds of millions of dollars?

Confronting those issues could put politicians at risk. But failure to do so leaves children and jobs at risk. Where are the eagles in Illinois public service who will take wing while flightless ostriches ignore reality, pander to our self-interest and cheat our kids, grandkids and the state they claim to love?

We've had, and are having, some spirited discussion on education funding on recent threads here, so let's try a different angle today. How do you feel about a revision of the state's sales tax structure to include certain services?

For point of reference as to some of the inequities in the present system, I will leave you with one of my favorite examples. In our state, the homeowner who buys a lawn mower to tend to his grass pays a sales tax on that purchase. But the wealthy individual who hires a landscaping company to take care of his property pays no sales tax for such service. There are myriad other examples along these lines, where there exist differences without clear supporting rationale for the same.

Is this inherently unfair, regressive, or is there a justification for keeping our system the way it is? Have at it. And obviously, feel free to address anything else raised by Mr. Lawrence in his article.

As the prosecution is on the verge of resting their case in chief in the trial of former Governor George Ryan, Eric Zorn gives his prediction that Ryan will not take the stand in his own defense.

As the prosecution is on the verge of resting their case in chief in the trial of former Governor George Ryan, Eric Zorn gives his prediction that Ryan will not take the stand in his own defense.